Teaching Excellence in Financial Planning

We've spent years developing methods that actually work. Our approach combines real-world financial expertise with proven educational techniques that help people master multi-year budget planning effectively.

Experience-Driven Learning

After working with hundreds of individuals and families struggling with long-term financial planning, we noticed something important. Traditional financial education often focuses on theory without practical application. People would learn concepts but couldn't implement them in their daily lives.

Our teaching philosophy centers on hands-on experience. Every lesson includes real scenarios from actual Australian households. Students work with genuine budget challenges, market fluctuations, and life changes that affect long-term planning. This isn't theoretical - it's the stuff that happens to real people.

We believe learning happens best when it feels relevant and immediately useful. That's why our curriculum adapts to current economic conditions and includes recent case studies from our consulting work in Tasmania and mainland Australia.

How We Structure Learning

Our methods have evolved through trial and error. We've tested different approaches and kept what actually helps people succeed with their financial goals.

Scenario-Based Learning

Each lesson starts with a real situation. Maybe it's a family planning for their child's education while managing a mortgage. Students work through the actual decisions and see immediate results.

Progressive Complexity

We start simple and build complexity gradually. First lesson might cover basic emergency funds. By month six, students are handling multi-year investment strategies and tax considerations.

Peer Collaboration

Students work in small groups on budget challenges. Different perspectives and experiences create richer learning. Plus, discussing money decisions with others reduces anxiety around financial planning.

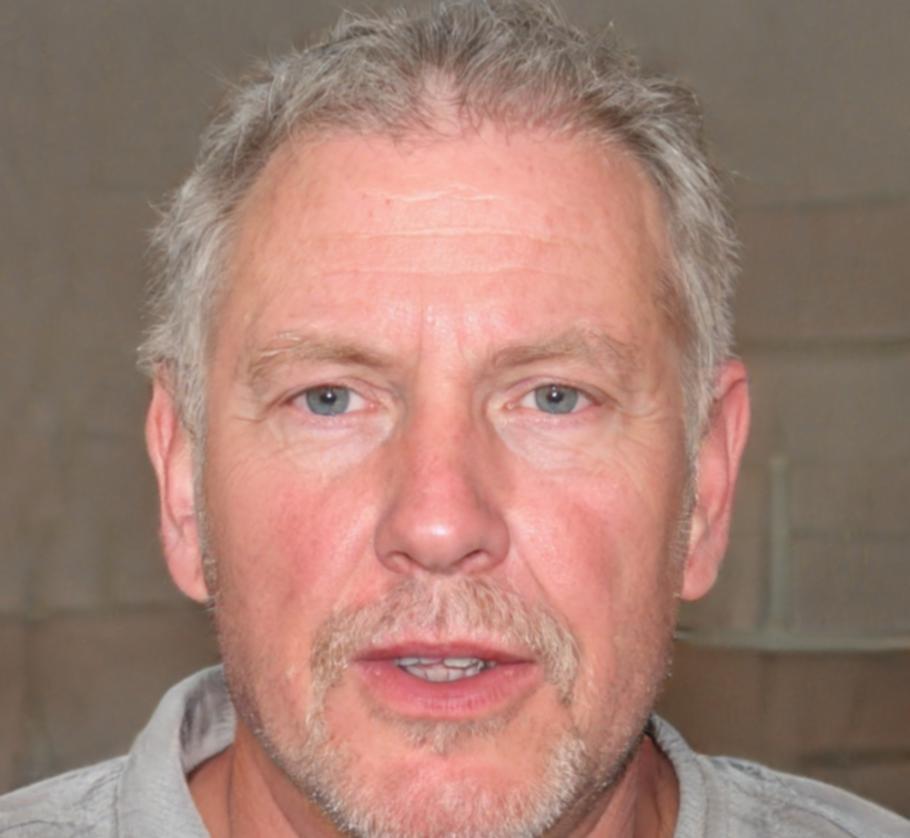

Meet Your Instructors

Our team combines decades of financial consulting experience with genuine passion for teaching practical skills.

Marcus Chen

Lead Financial Instructor

Marcus spent twelve years as a financial advisor before transitioning to education. He's particularly skilled at breaking down complex investment concepts and helping people understand tax implications of long-term planning. His background includes work with mining families in Tasmania, which gives him insight into irregular income planning.

Sarah Mitchell

Budget Strategy Specialist

Sarah brings fifteen years of experience helping families navigate major life transitions. She's worked extensively with divorce financial planning, career changes, and retirement preparation. Her teaching style focuses on practical worksheets and step-by-step processes that students can apply immediately.

What Students Achieve

Our programs run for twelve months because real financial planning skills take time to develop. Here's what typically happens during that journey:

Foundation Building

Students create their first comprehensive budget and establish emergency funds. Most people are surprised by how much they can save once they track spending accurately. We see confidence grow as people gain control over their monthly cash flow.

Strategic Planning

Introduction to investment basics and long-term goal setting. Students learn to balance debt reduction with wealth building. This phase includes understanding superannuation strategies and tax-effective investing within Australian regulations.

Advanced Concepts

Property investment considerations, business financial planning, and advanced tax strategies. Students work on multi-year scenarios that include economic uncertainty and changing life circumstances.

Integration and Mastery

Students create comprehensive financial plans spanning 5-10 years. Final projects involve presenting strategies to peers and receiving feedback. Many students report feeling genuinely confident about their financial futures for the first time.

Ready to Start Learning?

Our next comprehensive program begins in September 2025. We limit class sizes to ensure personalized attention and meaningful peer interaction.

Explore Program Details